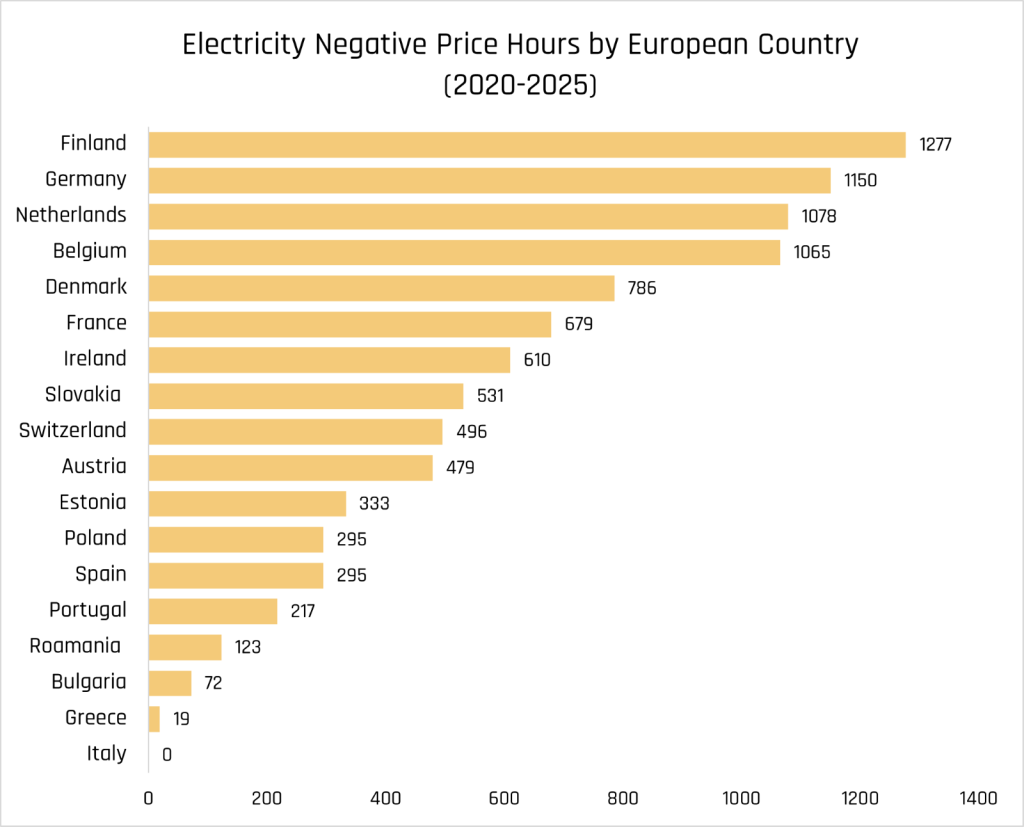

Europe experienced over 1,000 hours of negative electricity prices in 2024, a phenomenon where power generators pay consumers to take their electricity. This counterintuitive market reality is fundamentally reshaping energy investment strategies and creating new opportunities for institutional investors seeking stable, climate-aligned returns.

Europe’s Energy Markets Reach a Tipping Point

European electricity markets have reached a point where supply and demand dynamics have flipped traditional pricing upside down. When renewable energy production exceeds consumption capacity, wholesale prices don’t just drop to zero—they go negative. In 2023, these events quadrupled to 821 hours, then surged to 1,031 hours by September 2024 (Eurelectric).

The mechanics are straightforward: excess renewable supply meets inflexible traditional generators that can’t easily shut down, creating a surplus that drives prices below zero. This transition from theoretical possibility to market reality is reshaping every aspect of energy investment strategy.

The Numbers Tell the Story

The scale of change across European markets in 2024 reveals the magnitude of this shift:

- Finland: 717 hours of negative prices, marking a 50% increase from 2023

- Germany: 455 negative price hours, continuing the 50% year-over-year growth trend

- Spain: Experienced negative prices for the first time, logging 244 hours

- Netherlands, Poland, Great Britain: All countries recorded substantial increases

The financial impact extends beyond mere statistics. In April 2024, more than one-third of Spain’s solar production occurred during negative pricing periods, while Germany regularly saw prices averaging -19 EUR/MWh during peak production months (Pexapark).

Source: Analysis based on data from Ember, “European Wholesale Electricity Prices – Hourly”

Understanding the Market Forces at Play

This pricing paradox stems from several converging factors that reveal the complexity of modern energy systems:

- Operational Realities: Traditional thermal power plants face substantial costs when shutting down and restarting, making it economically rational to continue operating even at negative prices for short periods.

- Policy Structures: Many renewable generators receive production-based subsidies that allow them to remain profitable even when market prices turn negative, creating incentives to keep producing regardless of market signals.

- System Inflexibility: The mismatch between when renewable energy is produced (sunny, windy periods) and when it’s most needed creates systematic oversupply during certain periods.

- Storage Limitations: Despite technological advances, battery storage capacity remains insufficient to absorb excess production and redistribute it to peak demand periods.

The Breakdown of Traditional Financing Models

Power Purchase Agreements (PPAs) have long served as the foundation of renewable energy project financing, offering 15–25-year contracts with predetermined prices that effectively removed market risk from project developers. This model is now under significant strain.

The data reveals a market in transition:

- European PPA volumes declined 11% in 2024 despite record renewable capacity additions

- Contract structures increasingly incorporate market-linked pricing rather than fixed rates

- Corporate buyers are becoming more selective, preferring shorter terms and shared risk arrangements

This creates what industry experts call the “renewable risk paradox”—project risks are escalating due to market volatility, yet expected returns haven’t adjusted proportionally to compensate investors for these new uncertainties.

Energy Efficiency: The Stable Alternative

As negative electricity prices Europe becomes increasingly common, energy efficiency projects operate under different economic principles that offer greater predictability. These investments create value by reducing energy consumption rather than competing in volatile generation markets.

Key advantages include:

- Contractual Certainty: Returns based on measured energy savings with predetermined payment schedules

- Market Independence: Cash flows largely independent of wholesale electricity price volatility

- Diversification: Portfolio approaches spread risk across multiple sectors and regions

- Essential Services: Energy remains necessary during economic downturns

Current global energy efficiency improvements progress at just 1% annually but need to reach 4% to meet climate targets, requiring investment to triple from $660 billion to $1.9 trillion annually by 2030.

Proven Success Stories

- Slovenia Public Sector Project: Solas Sustainable Energy Fund and Resalta’s retrofit of educational and healthcare facilities achieved 757,387 kWh in annual savings and 351,390 kg CO₂ reductions while providing investors 5.75% returns with stable quarterly cash flows.

Strategic Investment Implications

Successful institutional investors are building balanced portfolios that combine both approaches:

- Renewable Generation: Offers growth potential but requires sophisticated risk management and active trading capabilities to navigate volatile pricing.

- Energy Efficiency: Provides stable, contractual cash flows that align with institutional liability matching while offering EU Taxonomy eligibility and climate impact.

Source: Thomas Despeyroux on Unsplash

The Institutional Investment Opportunity

For institutional investors seeking stable, long-term returns with meaningful climate impact, energy efficiency project debt represents a compelling opportunity. These investments offer fixed cash flows through contractual off-take agreements, diversified counterparty exposure across sectors, limited correlation to traditional assets, and security from the essential nature of energy services. Projects align with Article 9 SFDR requirements and EU Taxonomy eligibility, satisfying increasingly stringent ESG mandates €150+ billion annual funding shortfalls for building efficiency improvements.

At Solas Capital AG we provide specialised financing solutions for demand-side energy projects, bridging the gap between institutional investors and high-impact energy efficiency projects. Our investment strategy provides fixed-income like returns, allowing investors to match their liabilities while gaining exposure to investments that feature:

- Long-term contractual cash flows without electricity price risk, typically seen in renewable energy projects

- Diverse counterparty exposure across multiple sectors and hundreds of off-takers

- Limited correlation to traditional asset classes

- Resilience during economic downturns due to the essential nature of energy services

By incorporating energy efficiency alongside renewable energy investments, institutional investors can build more complete and balanced climate-aligned portfolios that simultaneously enhance energy security and economic resilience.

Looking Ahead

European energy markets have fundamentally changed. Negative pricing events reflect renewable energy’s success but demand new investment strategies. While generation projects offer higher returns, they require active management expertise. Energy efficiency provides complementary stability through predictable cash flows from essential services.

The institutions that thrive will develop capabilities to manage both investment types, building portfolios that balance growth with reliability. As negative pricing becomes common, the steady returns from energy efficiency may prove increasingly valuable for climate-aligned institutional strategies.