Hydrogen has been promoted as a game-changing solution to climate change and improving energy efficiency. Supporters highlight its appealing qualities: it can be made in multiple ways, uses abundant materials, stores energy for long periods, and produces no carbon emissions when used. The basic idea sounds logical, hydrogen acts as a clean fuel that carries energy from one place to another, solving problems that other renewable energy sources can’t handle.

But when you examine the actual evidence, hydrogen falls short of these promises. Every method of producing hydrogen, whether using fossil fuels, nuclear power, or renewable energy, wastes more energy than simply using that electricity or heat directly.

Much of the hydrogen momentum comes from established energy companies seeking to repurpose their existing infrastructure for new applications. Despite twenty years of bold predictions about a hydrogen revolution, very little has been built, while proven alternatives continue delivering real results.

The Reality of Hydrogen Production: Energy Efficiency Concerns

While hydrogen is abundant in the universe, it doesn’t exist by itself in nature in any form we can easily extract. Instead, hydrogen is always attached to other elements, most commonly in water (H₂O) or natural gas (methane).

Obtaining hydrogen requires breaking these chemical bonds through various industrial processes. The dominant method today is steam methane reforming, where methane reacts with water to produce hydrogen and carbon dioxide.

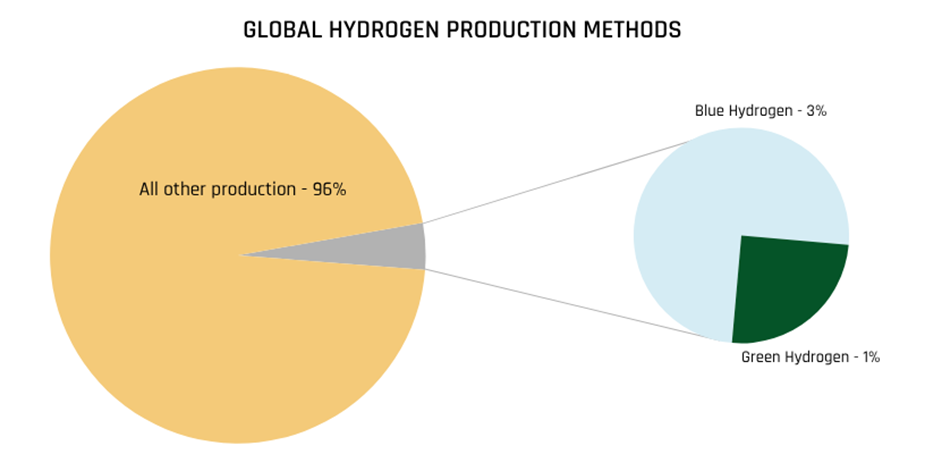

Source: IEA (2024)

99% of hydrogen comes from this fossil fuel process, 3% uses the same method but captures some CO₂ emissions, and only 1% comes from clean electrolysis using renewable electricity.

The Hydrogen Problem

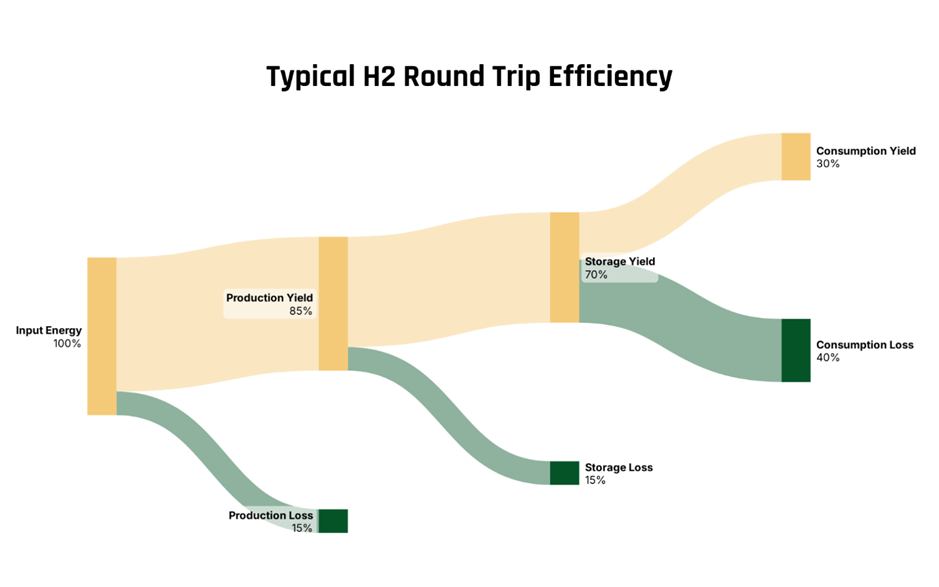

Even if hydrogen production improved dramatically, the technology faces fundamental challenges as an energy carrier. The complete process, from production through storage, transport, and final use, reveals why hydrogen struggles to compete. After production losses, hydrogen must be compressed, liquefied at extremely cold temperatures, or converted to other molecules for storage and transport.

These steps consume another 6-25% of the original energy because hydrogen has very low energy density at normal temperatures.

Source: Indicative, based on Renewable Energy and Medium

The complete round-trip efficiency of converting electricity to hydrogen and back to usable energy ranges from just 18-46%. This means a hydrogen-based system would require 3-5 times more power generation capacity to deliver the same amount of energy to consumers. With limited resources and pressing climate deadlines, this level of systematic inefficiency makes hydrogen unsuitable for most energy applications.

The Ethanol Precedent

The US has already run this experiment with another “clean” fuel that promised environmental benefits but delivered expensive disappointment. Ethanol biofuel, promoted as a solution for energy security and environmental protection, required $45 billion in subsidies between 1980-2011 while achieving carbon reductions at a cost of $750 per metric ton. Like hydrogen, ethanol is fundamentally inefficient, corn farming captures only about 10% of solar energy through photosynthesis, then requires energy-intensive processing to produce fuel with lower energy density than gasoline.

Hydrogen’s True Applications

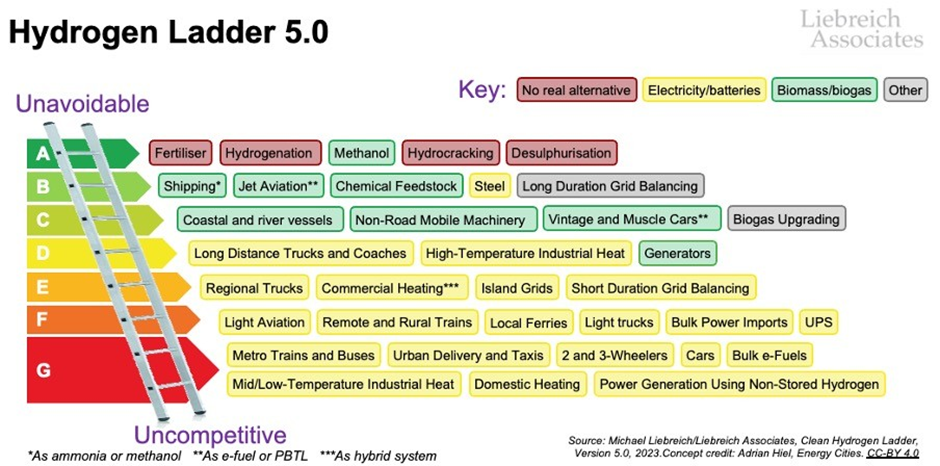

The Hydrogen Ladder framework reveals that hydrogen has legitimate but limited applications in the energy system. At the top of this ranking sit industrial processes like fertilizer and steel production, where hydrogen serves as a necessary chemical ingredient rather than just an energy source.

Beyond these essential uses, hydrogen might serve as backup power during extended periods when wind and solar generation is low, though even this faces competition from improving battery technologies and better grid connections.

Source: Michael Liebreich Associates, Clean Hydrogen Ladder Version 5.0

However, hydrogen faces structural cost challenges that limit broader deployment. Unlike solar panels or batteries where costs drop dramatically with scale, hydrogen systems depend heavily on expensive infrastructure, that won’t get much cheaper over time.

The fundamental economics create a problem: hydrogen facilities need to run constantly to be profitable, but they depend on renewable electricity that must first meet higher priority demands from homes and businesses, leaving insufficient power for consistent hydrogen production.

The Investment Reality: Why Hydrogen Economics Don’t Work

The numbers tell a stark story about hydrogen’s economic viability. Meeting global hydrogen targets would require $1.3 trillion in subsidies, yet Bloomberg NEF expects “few places in the world where clean hydrogen will compete by 2050.”

The investment community has delivered its verdict: only 2% of announced hydrogen projects reached final investment decision in 2023, with major projects being cancelled despite substantial government support.

Hydrogen faces three fundamental investment risks that make it unsuitable for large-scale deployment:

- Complete dependence on subsidies creates regulatory uncertainty

- Lack of competitive pricing means virtually no long-term purchase contracts exist

- The need for constant electricity supply creates resource risks that other clean technologies avoid.

The Proven Alternative: Energy Efficiency

While hydrogen struggles with fundamental economics and physics, energy efficiency offers immediate, profitable solutions that work today. Energy efficiency represents the single largest component of emissions reduction in net-zero scenarios, providing the most cost-effective approach to decarbonization.

The European Union faces an investment gap of €185-434 billion annually in building efficiency alone, representing enormous opportunities across residential, commercial, and industrial sectors.

Unlike hydrogen, these investments don’t require subsidies to be profitable. Technologies like improved insulation, efficient heating systems, rooftop solar, and LED lighting deliver immediate energy savings that pay for themselves over time.

Energy Efficiency: The Investment Opportunity

Energy efficiency provides the proven, financially stable investment opportunities that hydrogen lacks. Unlike hydrogen’s dependence on government support, energy efficiency projects generate immediate cost savings that make them profitable from day one. These investments rely on established technologies, like rooftop solar, building insulation, efficient heating systems, and LED lighting, that are readily available and highly reliable.

The payment structures typically follow fixed-income characteristics based on energy savings rather than volatile market prices, making them particularly attractive to pension funds and insurance companies seeking stable, long-term cash flows that match their liability profiles.

Solas Capital and PAUL Tech

Solas Capital’s partnership with PAUL Tech demonstrates how energy efficiency investments deliver immediate results. Through their Heating-as-a-Service model, PAUL Tech has deployed IoT-powered heating optimization across several residential units in Germany. Their Frankfurt case study exemplifies this success: a 19-story building improved from energy Class F to Class D, saving €36,700 annually while eliminating 60 tonnes of CO2 emissions from day one.

Conclusion

The evidence points to a clear choice between chasing expensive promises and deploying proven solutions. Energy efficiency investments offer immediate benefits, addressing climate goals, enhancing energy security, and generating attractive financial returns. Unlike hydrogen’s dependence on future subsidies, energy efficiency relies on proven technologies backed by clear regulatory frameworks.

While the EU and national governments can contribute, financial institutions and investors are also required to participate to close the investment gap and accelerate the transition to a more efficient, secure, and sustainable energy system. Given the attractive profile and range of possible investments, the question investors should be asking themselves is: why not?