Germany faces one of its greatest infrastructure challenges in implementing the revised 2024 Energy Performance of Buildings Directive (EPBD). This regulation applies to existing buildings to achieve zero emissions by 2030, with a complete phase-out of fossil fuels mandated by 2040.

Yet only 6% of Germany’s current building stock complies, leaving a massive investment need estimated at €60-65 billion annually. Buildings failing to meet standards face financing restrictions, carbon pricing penalties, and value discounts up to 30%.

The EPBD sets ambitious milestones, including zero-emission standards for all new buildings by 2030 and prioritization of renovations for the worst-performing 43% of buildings.

Germany’s unique challenges stem from its extensive residential and commercial stock, stringent tenant protections, and regional implementation variance. Market pressures from carbon pricing and EU regulations will affect financing access and property valuations.

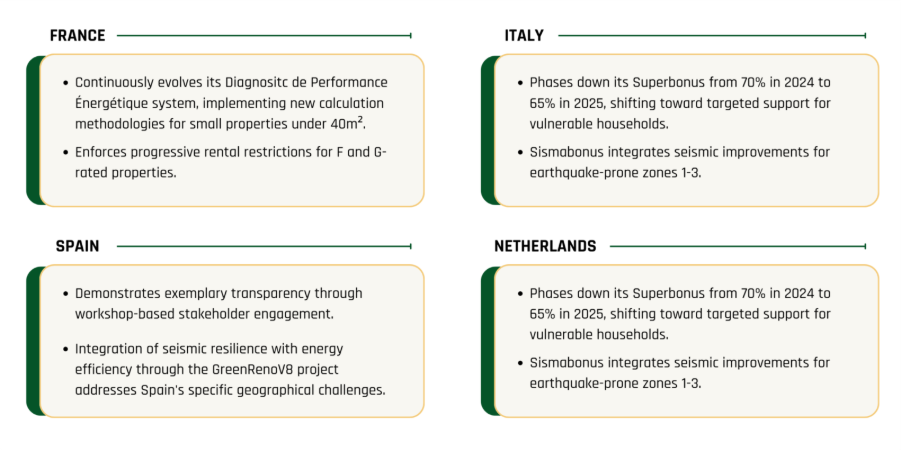

National Perspectives: EPBD Implementation across Europe

Germany is implementing the EPBD through its updated Building Energy Act (GEG), which requires that all new heating systems use at least 65% renewable energy. The Act also prioritizes renovations of public buildings, focusing on achieving collective efficiency targets rather than imposing individual mandates. While Germany adopts its neighbourhood approach, other EU member states are developing distinct implementation strategies worth examining.

France continuously evolves its DPE system, enforcing rental restrictions for low-performance properties while focusing on social housing and energy poverty.

Spain faces constitutional constraints requiring legislative amendments before full EPBD implementation and integrates seismic resilience with energy efficiency through targeted projects.

Italy phases down its Superbonus and accommodates heritage protections, while the Netherlands develops new energy label classifications and mandates renewable energy connections. These varied strategies reflect national tailoring of the EPBD to local building stock, climate, and policy contexts.

Innovative Approaches and Early Mover Advantages

Germany adopts a “Quartiersansatz” neighborhood approach to compliance, enabling portfolio-wide renovations that respect tenant protections. Early movers stand to gain competitive advantages, avoiding rising costs and capturing green building rental premiums of 8-15%. The residential building retrofit market presents a €400-600 billion opportunity through 2045, driven by the need to transition 75% of buildings still relying on fossil fuel heating.

Case Study: Transforming Buildings with Energy-as-a-Service

A key innovative financing solution is Energy-as-a-Service (EaaS), which eliminates upfront capital barriers by offering performance-based contracts. EaaS models enable comprehensive modernizations with positive cash flow from day one and transfer technical risks to Energy Service Companies. A demonstrative case study modernized two residential complexes (75 units). Originally Class E modernized to Class A ratings using heat pumps, solar PV, intelligent controls, and AI-driven management, achieving over 70% primary energy reduction and near elimination of CO2 emissions in just four weeks without tenant displacement.

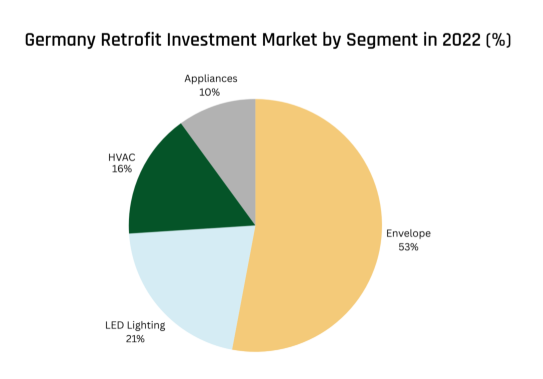

Growing Market and Investment Opportunities

Investment opportunities include a rapidly expanding ESCO market supported by KfW federal funding and regional incentives. German institutional investors benefit from stable cash flows in EaaS portfolios aligned with EU sustainable finance taxonomy, bridging the €60 billion annual financing gap.

The European Commission’s Impact Assessment for the EPBD revision estimates that achieving the EU’s 2030 building targets requires approximately €275 billion in annual investments across all member states. Germany’s share, based on its 22% proportion of EU building stock, translates to €60-65 billion annually through 2030.

Proven Technical Solutions for Reliable Performance

Heat pump installations are essential for German EPBD compliance, with one of Europe’s largest markets achieving efficiencies of 300-400% compared to electric heating. Germany’s photovoltaic sector is rapidly expanding, with 82 GW installed as of early 2024 and significant rooftop potential remaining. Intelligent building controls using IoT sensors and machine learning enable 15-30% energy savings through optimization, hydraulic balancing, and weather-predictive management. Integrated, these technologies can reduce building energy consumption by 50-75%, maintain comfort levels, and provide grid flexibility critical to the energy transition.

Conclusion: Seize the Moment

Germany’s building decarbonisation represents a substantial investment proposition within Europe’s broader transition to net zero and energy security, underpinned by comprehensive regulatory frameworks. Capital allocation across the continent increasingly favours retrofit initiatives, creating new market segments such as Energy-as-a-Service. Institutional investors can benefit from this long-term trend and shape Europe’s energy resilience whilst achieving impact and market rate returns.