For decades, Germany has built its economic powerhouse on imported fossil fuels, creating a dependency that costs approximately €600 billion over five years. This massive capital outflow represents not just an environmental challenge but a fundamental economic opportunity through energy efficiency investment in Germany. The 2022-2023 energy crisis highlighted this vulnerability, forcing Germany to rapidly diversify away from Russian pipeline gas and adapt its energy infrastructure.

The €120 Billion Economic Opportunity

By shifting focus from energy costs to energy savings, Germany could redirect 20% of its fossil fuel import bill—saving €120 billion over five years. This money would strengthen domestic industries, create jobs, and improve trade balances rather than flowing to energy exporters. Each 1% reduction in consumption represents approximately 9.7 TWh less imported natural gas, significantly enhancing energy security.

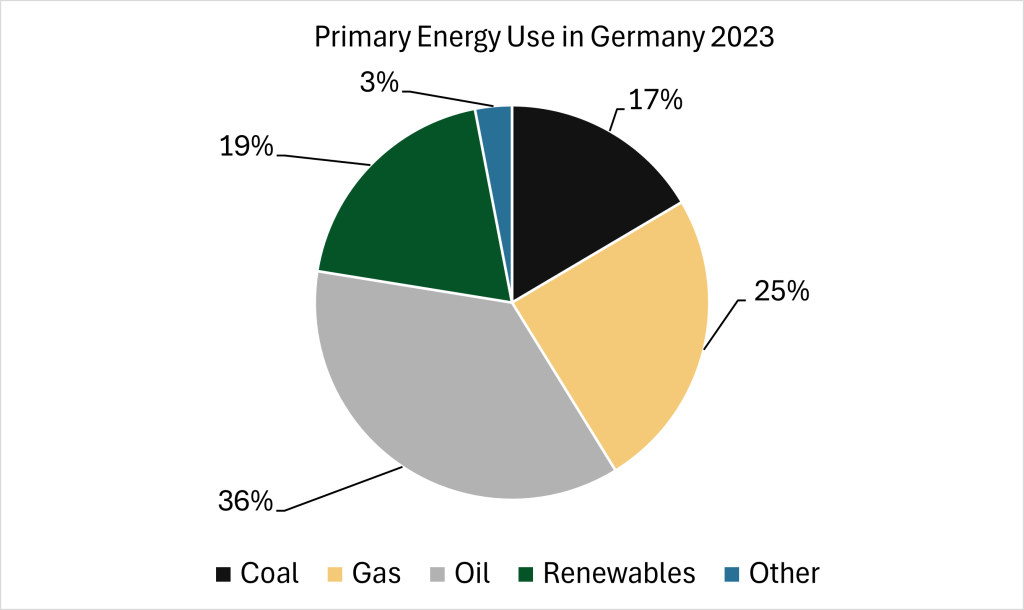

In 2023, most of the primary energy use in Germany was provided by fossil fuels:

Source: Umweltbundesamt

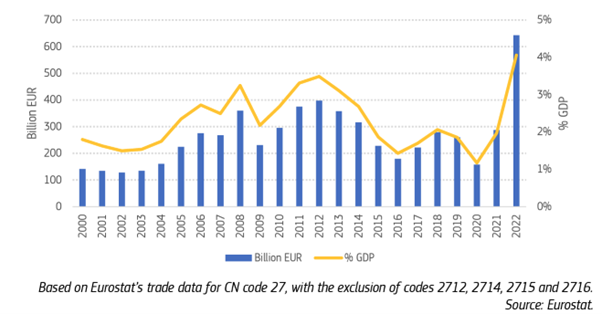

EU Fossil Fuel Dependency: A Growing Economic Burden

With the surge in energy prices in 2022, gross fossil fuel imports rose to more than EUR 800 billion, equivalent to 5.1% of GDP and 26.9% of merchandise imports, the highest level in the past two decades relative to GDP. On a net basis (imports minus exports), fossil duel imports represented €649 billion in 2022 or 4.1% of GDP, compared to an average of 2.2% of GDP in 2000-2021.

Source: Eurostat

High-Impact Technologies with Rapid Returns

Two proven technologies offer immediate savings with impressive ROI:

- LED Lighting: 50-80% lower energy consumption with 18-month average payback periods.

- High-efficiency Pumps: 30-50% reduced energy consumption with 24-month average payback.

Source: @toilavu

These technologies alone could deliver 30-45 TWh in annual savings, directly benefiting energy-intensive sectors where energy represents 5-10% production costs. Industrial customers consumed 302.3 TWh in 2023, representing substantial savings potential through modern efficiency solutions.

Zero Upfront Cost Solutions

The initial investment cost often presents a barrier to implementing efficiency measures. However, the Energy-as-a-Service model eliminates the obstacle by requiring no upfront capital. Through long-term service contracts, businesses simply pay a monthly fee that’s lower than what they previously spent on energy, generating positive cash flow from day one. This win-win approach benefits both energy users and service providers while accelerating adoption of efficiency technologies across industries.

Beyond Individual Savings: Economy-Wide Benefits

Energy efficiency delivers multiple advantages beyond cost savings:

- Enhanced energy security through reduced import dependence

- Improved trade balances and strengthened euro

- Price stability through reduced peak demand

- Job creation in retrofitting and industrial efficiency sectors

The Institutional Investment Opportunity

For institutional investors seeking stable, long-term returns with meaningful climate impact, energy efficiency project debt represents a compelling opportunity. These investments offer fixe cash flows through contractual off-take agreements, diversified counterparty exposure across sectors, limited correlation to traditional assets, and security from the essential nature of energy services. Projects align with Article 9 SFDR requirements and EU Taxonomy eligibility, satisfying increasingly stringent ESG mandates €150+ billion annual funding shortfall for building efficiency improvements.

Transforming Germany’s Energy Future

Germany stands at a critical economic inflection point. By embracing energy efficiency investment in Germany as a core economic strategy rather than viewing it as a cost burden, the country can strengthen its position against external shocks while leading Europe’s transition to a more secure and sustainable future. Through innovative financing and proven technologies, like LED lighting and high-efficiency pumps, this transformation can happen today—retaining billions within the German economy while accelerating environmental progress.