The 2022 energy crisis rewrote the rules of European business resilience. As energy prices increased and supply chains struggled, a clear pattern was seen: companies with strong energy efficiency programs were thriving. These businesses showed 40% less vulnerability to energy price fluctuations while maintaining operational stability and competitive advantage.

This transformation revealed a fundamental truth: in an era of energy volatility, the most powerful strategy is not securing more energy, but rather needing less.

Building Resilience: Security through Efficiency

Energy efficiency creates what researchers call “resilience multipliers”, these are benefits that extend beyond reduced utility bills. Advanced energy management systems enable predictive maintenance, extend equipment life, and provide operational flexibility that was previously impossible. For Small and Medium Enterprises (SMEs), improved efficiency translates to reduced exposure to price volatility, better cash flow management and enhanced competitiveness.

According to the European Commission’s quarterly report on EU gas and electricity markets in 2023, European companies achieved a 20% reduction in natural gas consumption in 2023 compared to pre-crisis levels while maintaining and often improving their competitive positions. This shows how efficiency measures create operational resilience without hurting performance.

The €149 Billion Investment Gap

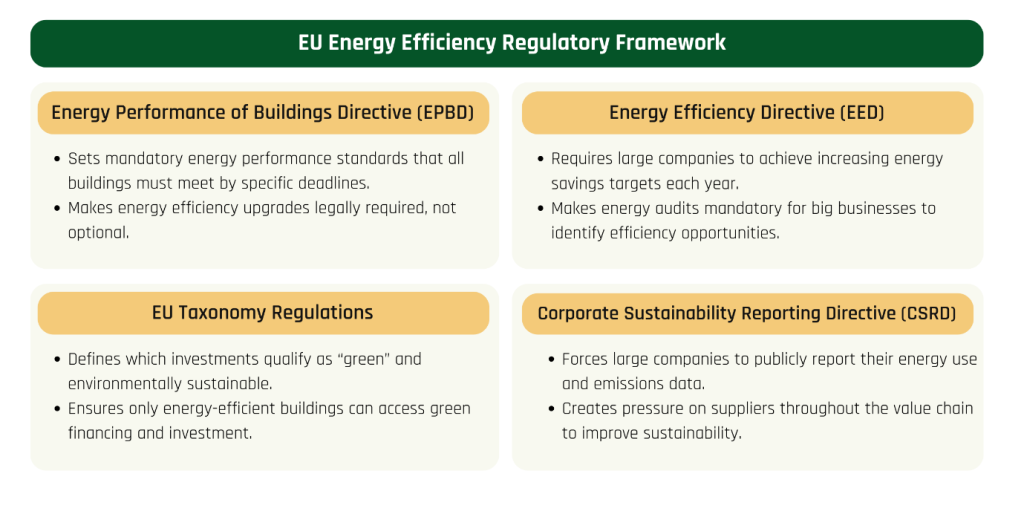

The achievement of widespread power of less requires more than economic incentives. It instead requires regulatory frameworks that create systematic market demand for efficiency solutions. The EU has pioneered this approach through four interconnected directives that transform compliance obligations into powerful drivers of energy efficiency investments (See Figure 1).

The most notable one is the Energy Performance of Buildings Directive (EPBD), which addresses the need to curb 40% of final energy use in the EU that currently originates from buildings. The EPBD creates unprecedented demand-side pressure through Minimum Energy Performance Standards (MEPS), requiring all non-residential buildings to achieve Energy Performance Certificates class F by 2040, and class E by 2033. Organizations must reduce energy consumption not as an option, but as a pre-requisite for continued operation.

This regulatory transformation creates what economists’ term “mandatory demand,” a market demand that exists not through consumer preference but through legal necessity. However, an analysis by Brussels-based think-tank, Bruegel, estimates that meeting EPBD targets requires €297 billion in total annual investments through 2030, with an annual financing gap of €149 billion, approximately 0.7% of the EU’s GDP.

While the EPBD is the cornerstone of Europe’s building energy reforms, its impact is amplified by three other key regulations. The Energy Efficiency Directive, which broadens energy savings obligations across industries, the EU Taxonomy Regulation, which directs finance toward sustainable investments, and the Corporate Sustainability Reporting Directive, which compels companies to disclose and act on their climate performance. Together, these regulatory frameworks establish an integrated system in which energy efficiency shifts from a voluntary objective to both a market expectation and a regulatory requirement.

Figure 1 – EU Energy Efficiency Regulatory Framework

This regulatory quarter (the EPBD, the EED, the Taxonomy and the CSRD) creates self-reinforcing demand-side dynamics that are essential for scaling the power of less across European industries. The integration of regulatory requirements with financing mechanisms exemplifies how policy frameworks enable the power of less at scale.

The Energy-as-a-Service Model

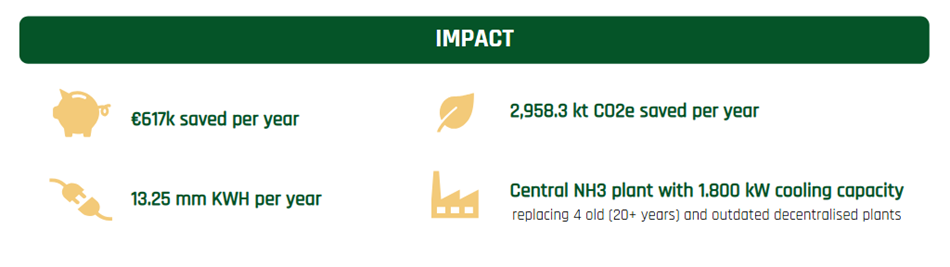

The breakthrough in scaling energy efficiency investments lies in the Energy-as-a-Service (EaaS) model that removes the upfront capital barrier. For example, a recent implementation by the German Energy Service Company, Encore Efficiency, demonstrates this approach.

Project Scope: 27 energy efficiency projects across multiple processing sites of a multinational dairy producer. (Source: Energy Efficiency Movement)

Results Achieved:

- 20% reduction in energy costs with zero upfront capital investment required

- 20,000 tonnes of CO2 eliminated annually

- Immediate positive cash flow from day one

This model transforms energy efficiency from a capital expenditure to an operational expense, allowing businesses to view immediate economic benefits while advancing sustainable goals.

The Time for Energy Efficiency Investment is Now

For institutional investors seeking to deploy capital at scale into real economy investments, European energy efficiency offers an optimal combination of:

- Opportunity Size: €149 billion annual market comparable to renewable energy infrastructure (to meet EPBD targets)

- Return Predictability: Underlying project agreements provide for fixed cashflows.

- Deployment Readiness: Established sector with proven technologies and operators.

- Regulatory Certainty: Fixed compliance deadlines create systematic demand.

- Climate Impact: Measurable decarbonization at scale.

Turning Regulation into Opportunity

Regulatory timelines are fixed and approaching rapidly, with compliance requirements taking effect in 2030. The infrastructure of tomorrow is being build today through strategic reduction of energy consumption. The power of less is not just an energy strategy, it is a €149 billion investment opportunity waiting to be unlocked.

At Solas Capital, we are at the forefront of enabling the building sector’s transition to lower energy solutions.