Europe’s energy transition has entered a fundamentally different phase. Renewables now shape system conditions by the hour, creating congestion and volatility that legacy grid assets were never designed to manage. Rather than building ever more supply infrastructure, demand-side flexibility lets consumers across industrial sites, commercial buildings, and households shift or modulate their electricity load to match system needs. Demand-side flexibility delivers material system savings, tangible consumer benefits, and measurable decarbonization.

The scale of the challenge is already visible in Europe’s electricity system. The cost of managing grid congestion across the European Union reached €4.2 billion in 2023, a figure that continues to climb as renewable capacity expands faster than the grid’s ability to accommodate it. At the same time, the range of average margins of capacity made available for trade in the day-ahead market was between 30 and 70 percent in 2023, highlighting the dramatic price volatility that has become the new normal rather than the exception. This volatility isn’t just a theoretical concern. Grid congestion in the European Union curtailed over 12 terawatt-hours of renewable electricity in 2023, causing an additional 4.2 million tons of carbon dioxide emissions that could have been entirely avoided.

Figure 1. EU Grid Congestion in Focus.

Why Flexibility Matters Now More Than Ever

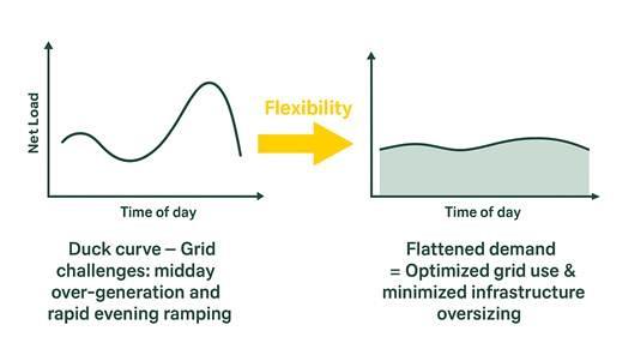

The fundamental challenge is timing. Wind farms generate maximum output at night when demand is lowest. Solar panels produce during the day, but residential demand peaks in the evening when solar output has declined. This mismatch creates two problems. During over-generation, clean electricity must be curtailed or exported at negative prices. During under-generation, expensive peaker plants that emit 40 to 60 percent more carbon dioxide must activate to maintain stability.

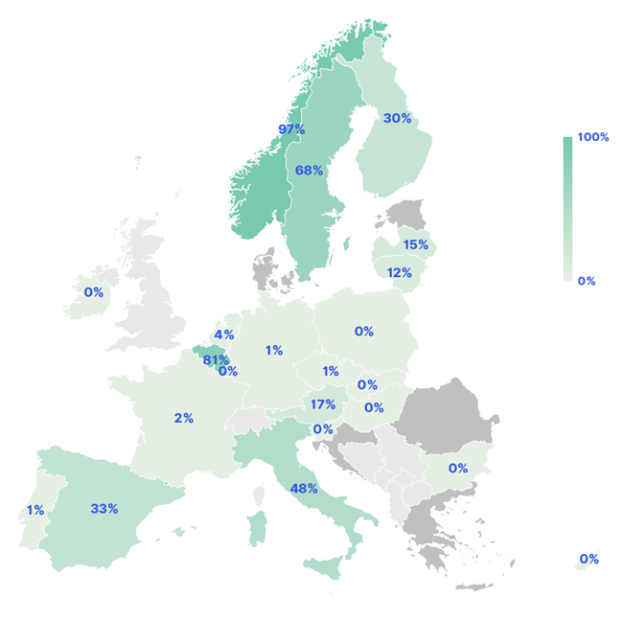

Europe already spends billions managing these constraints, yet 73% of European Union households remain on fixed-price contracts that dampen the price signals needed to trigger flexible consumption. Belgium proves change is possible, achieving 81 percent household dynamic contract uptake within existing European Union frameworks, while Sweden reaches 68 percent and Finland 30 percent.

Figure 2. Percentage of Households with Dynamic Contract Uptake.[1]

Understanding What Demand-Side Flexibility Actually Means

The European Commission defines demand-side flexibility as the ability of a customer to deviate from normal electricity consumption in response to price signals or market incentives. In practice, this means industrial facilities shifting electric arc furnaces to nighttime hours when wind generation is strongest, or aluminum smelters modulating power consumption by 20 percent without compromising product quality. Thermal storage systems allow facilities to build heat reserves when renewable electricity is plentiful, then coast through expensive peak periods.

Commercial buildings offer significant flexibility through their heating, ventilation, and air conditioning systems. A large office building can pre-cool by two or three degrees during morning solar generation, then allow temperatures to drift slightly during afternoon peaks while maintaining occupant comfort. The building’s thermal mass effectively acts as a battery. Refrigeration systems in supermarkets can shift intensive cooling cycles to off-peak hours, leveraging thermal inertia to maintain product quality.

Residential consumers, while individually small, represent enormous aggregate potential when coordinated. Smart electric vehicle chargers defer charging to overnight hours when electricity is cheaper and cleaner. Household appliances automatically shift to periods of low grid stress. Home battery storage systems absorb grid electricity when prices are low and discharge when prices spike.

The Joint Research Centre projects flexibility requirements will more than double by 2030, reaching 24 percent of total electricity demand, rising to 30 percent by 2050. Without activating this flexibility, Europe cannot integrate the renewable capacity needed to meet climate targets without economically unfeasible overbuilding of infrastructure.

Figure 3. 2030 Flexibility requirements.

The Substantial Value at Stake

Europe’s upside from activating demand-side flexibility at scale is substantial. Comprehensive modeling demonstrates annual consumer savings of €71 billion through optimized consumption patterns, translating to 10 to 40 percent reductions in household electricity bills. Large industrial consumers can save millions of euros annually per facility through strategic load shifting.

The carbon impact is equally impressive. Demand-side flexibility can avoid 37.5 million tons of greenhouse gas emissions annually by 2030, equivalent to removing 8 million combustion-engine vehicles from European roads. This happens through three mechanisms: consuming renewable energy when produced prevents curtailment, reducing the need for inefficient peaker plants that emit 40 to 60 percent more carbon dioxide, and enabling sector coupling where renewable electricity directly replaces fossil fuels in heating and industrial processes.

The renewable utilization benefits are striking. Demand-side flexibility can avoid 15.5 terawatt-hours of renewable curtailment annually by 2030, representing 61 percent of curtailment that would otherwise occur. Currently, when renewable generation exceeds grid capacity, system operators must curtail production. Demand-side flexibility transforms this by creating consumption capacity that absorbs excess renewable generation whenever it occurs.

From an infrastructure perspective, demand-side flexibility enables €11.1 to €29.1 billion in deferred grid investments. Traditional approaches require building transmission and distribution capacity that sits idle most of the time. By flattening demand peaks, the same infrastructure serves more consumption without costly upgrades, creating value shared between consumers through lower network charges and utilities who redirect capital to other needs.

Figure 4. Potential of Demand-Side Flexibility Quantified. [1]

How Demand-Side Flexibility Works at Scale

The shift from traditional one-way grids to renewable-dominated systems requires fundamental transformation. Traditional grids operated through simple hierarchy: power plants generated, networks distributed, consumers used. Today’s renewable grid demands bidirectional flows, real-time coordination across millions of devices, and distributed intelligence that responds faster than centralized systems.

Demand-side flexibility operates through three integrated layers. The measurement and communication layer uses smart meters to capture consumption data at 15-minute intervals or faster, transmitting data to grid operators in real-time. This establishes consumption baselines and provides verification that participants delivered committed flexibility.

The control and aggregation layer applies intelligence to transform data into actionable flexibility. Machine learning algorithms analyze consumption patterns, weather conditions, and user behavior to predict available flexibility. Advanced optimization engines aggregate flexibility from diverse sources, building reliability through diversification. The control layer operates across multiple time horizons: day-ahead forecasting for wholesale markets, intraday optimization as conditions change, and real-time dispatch for immediate response.

The device response layer executes commands. Industrial SCADA systems enable sub-second frequency response from large loads like electric arc furnaces. Building management systems adjust HVAC based on price signals, implementing pre-cooling during low-price periods. Smart appliances and electric vehicle chargers shift consumption autonomously based on user preferences.

Together, these layers transform a rigid electricity system into a responsive network that can absorb variability without constant manual intervention, enabling demand to shape itself around renewable supply patterns.

Figure 5. Flexibility: Grid Impact Metrics

The Investment Opportunity

Demand-side flexibility creates investment opportunities delivering both financial returns and measurable climate impact. It defers grid capital expenditure, generates carbon dioxide emission reductions aligning with environmental, social, and governance mandates, and produces consumer bill savings that generate predictable cash flows. With proper structuring, behind-the-meter flexibility upgrades can be transformed into cash-flowing portfolios offering fixed-income-like returns through contracted revenue sharing agreements.

Solas Capital stands at the forefront of this transformation, bridge the gap between institutional investors and high-impact energy efficiency projects, providing fixed-income-like returns that help investors match liabilities while supporting the energy transition.

The path forward is clear. The value is quantifiable. The time for action is now.